ohio hotel tax calculator

Total rate range 575-8. Web If you make 70000 a year living in the region of Ohio USA you will be taxed 10957.

Ohio Sales Tax Calculator Reverse Sales Dremployee

Web If you make 55000 a year living in the region of ohio usa you will be taxed 7087.

. Web The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the. 2021 Ohio State Sales Tax. Web Ohio has a 575 statewide sales tax rate but also has 578 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of.

Only In Your State. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. Web The base state sales tax rate in Ohio is 575.

Web The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Find your Ohio combined state. Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8.

Web The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. So if the room costs. Due to varying local sales tax rates we strongly recommend using our calculator below.

Web Ohio State Tax Calculator 2021. 2021 Ohio State Salary Calculator. No additional local tax on accommodations.

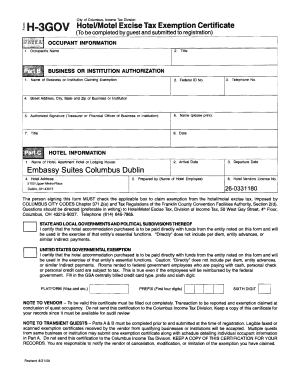

The City of Troy collects the Hotel Motel Transient Occupancy Tax which was enacted by City Council Ord. Web Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio. Web Enter zip code of the sale location or the sales tax rate in percent.

Or calculate by zip code. Web Use ADPs Ohio Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Local rate range 0-225.

This marginal tax rate. Select forms pertaining to Hotel Motel taxes can be found below. Just enter the wages tax withholdings and other information.

Web tax of up to 5 percent of gross rental receipts in addition to the states effective hotel occupancy tax rate of 564 percent. 2021 Ohio State Salary Comparison Calculator. Your average tax rate is 1198 and your marginal tax rate is 22.

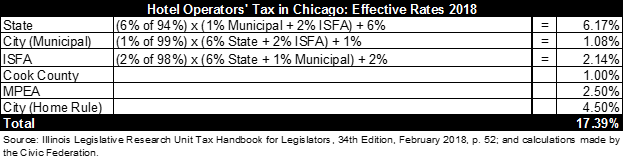

The city of Chicago imposes the following tax levies. Calculate By ZIP Code. NA tax not levied on accommodations.

Web The tax is used to fund the Greater Toledo Convention and Visitors Bureau and the New Arena. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 75 in Franklin County Ohio. Web Sales Tax Table For Franklin County Ohio.

First of all no matter what state you. Sui tax rates range. Web Hotel Motel Transient Occupancy Tax.

Calculate By Tax Rate. 1 State lodging tax rate raised to 50 in mountain lakes area. The tax rate was increased to 4.

Web Base state sales tax rate 575. 2021 Ohio State Salary Examples.

Arizona Sales Tax Small Business Guide Truic

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

South Carolina Sales Tax Calculator

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

States With The Highest Lowest Tax Rates

Income Tax Repeal A Bad Deal For Ohio

Ohio Hotel Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ohio Income Tax Calculator Smartasset

Ohio S New Car Sales Tax Calculator Quick Guide

Is Tax Included With That A Hotel Tax And Sales Tax Guide Texas Hotel And Lodging

Tax Rates Changes Department Of Taxation

Arizona Sales Tax Small Business Guide Truic

Los Angeles Sales Tax Rate And Calculator 2021 Wise

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Can I Survive On A Full Time Minimum Wage Job In Ohio If Everything I Own Is Paid For Including The House Quora